🚀 Feature Log

January 19, 2026

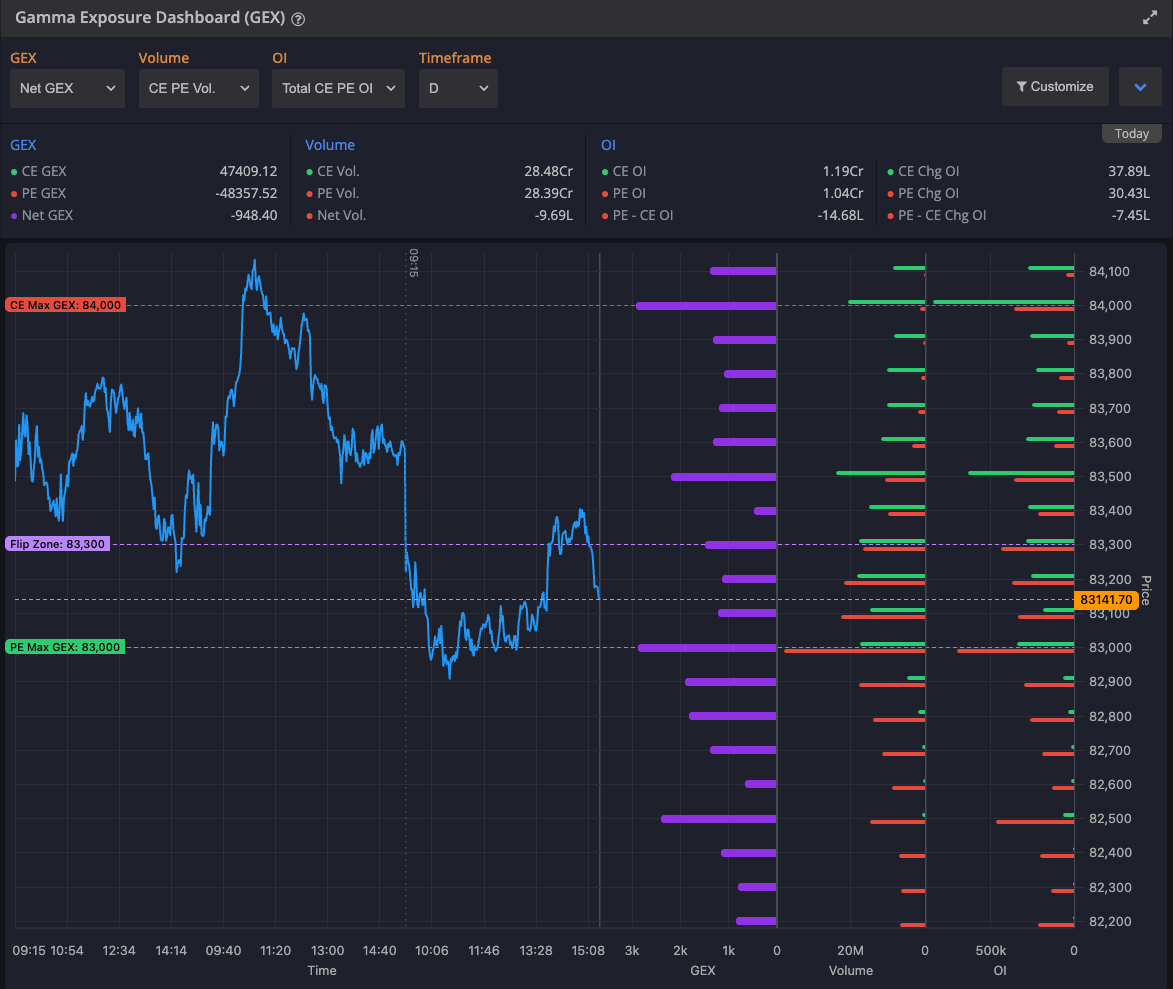

Added "Gamma Exposure Dashboard (GEX)"

Gamma Exposure Dashboard pulls up volume, open interest, and gamma across multiple strikes for the same symbol. Identify option dealer supply & demand levels, Real-time gamma exposure on Total, Daily, and 5,15, 30, 60 minute time frames.

December 20, 2025

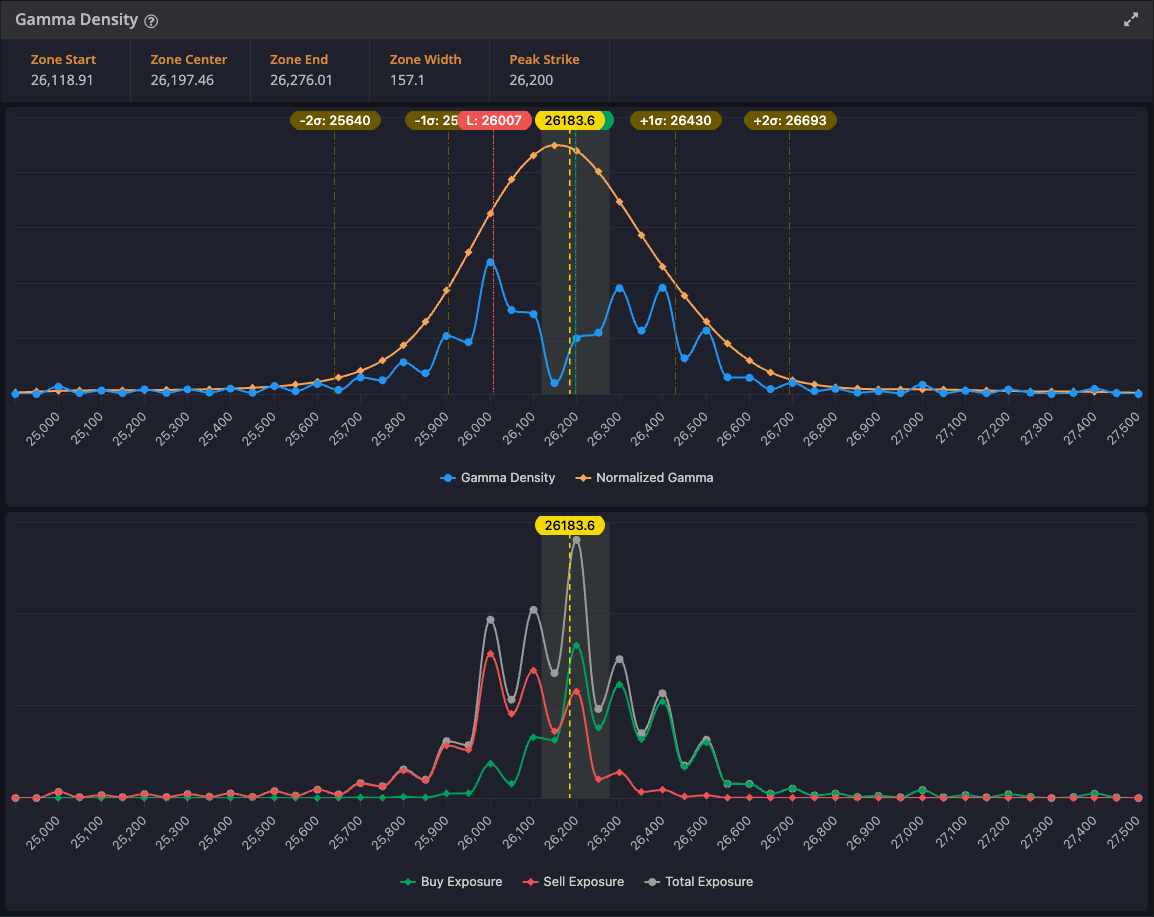

Added "Gamma Density & Convexity"

Gamma density refers to the probability density function (PDF) of the gamma distribution, a continuous probability distribution used to model waiting times or non-negative random variables. Its shape depends on shape and scale parameters.

December 18, 2025

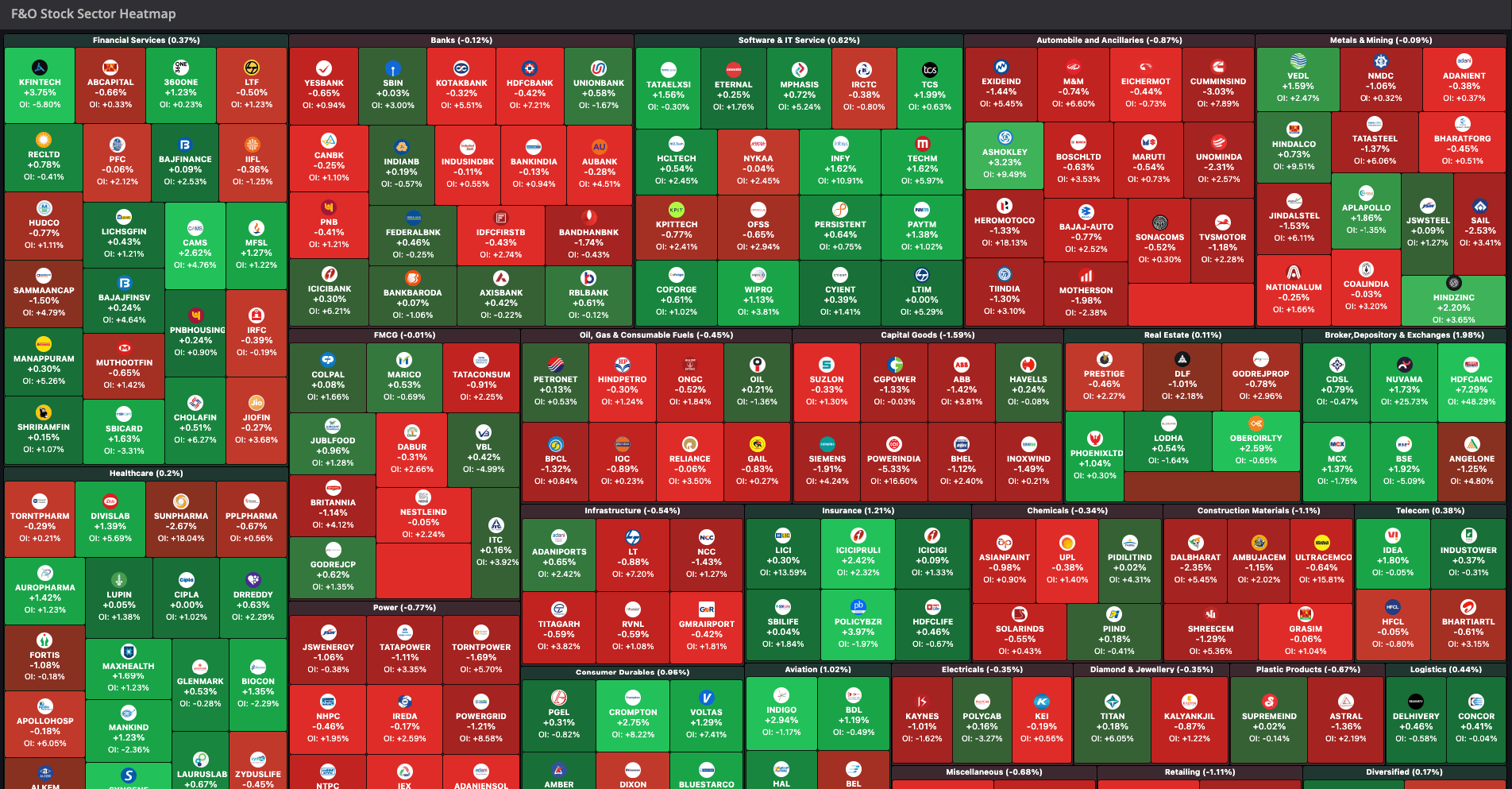

Added "F&O Stock Sector Heatmap"

The "F&O Stock Sector Heatmap" added all F&O stocks sector heatmap. Also we added OI changes in %.

December 17, 2025

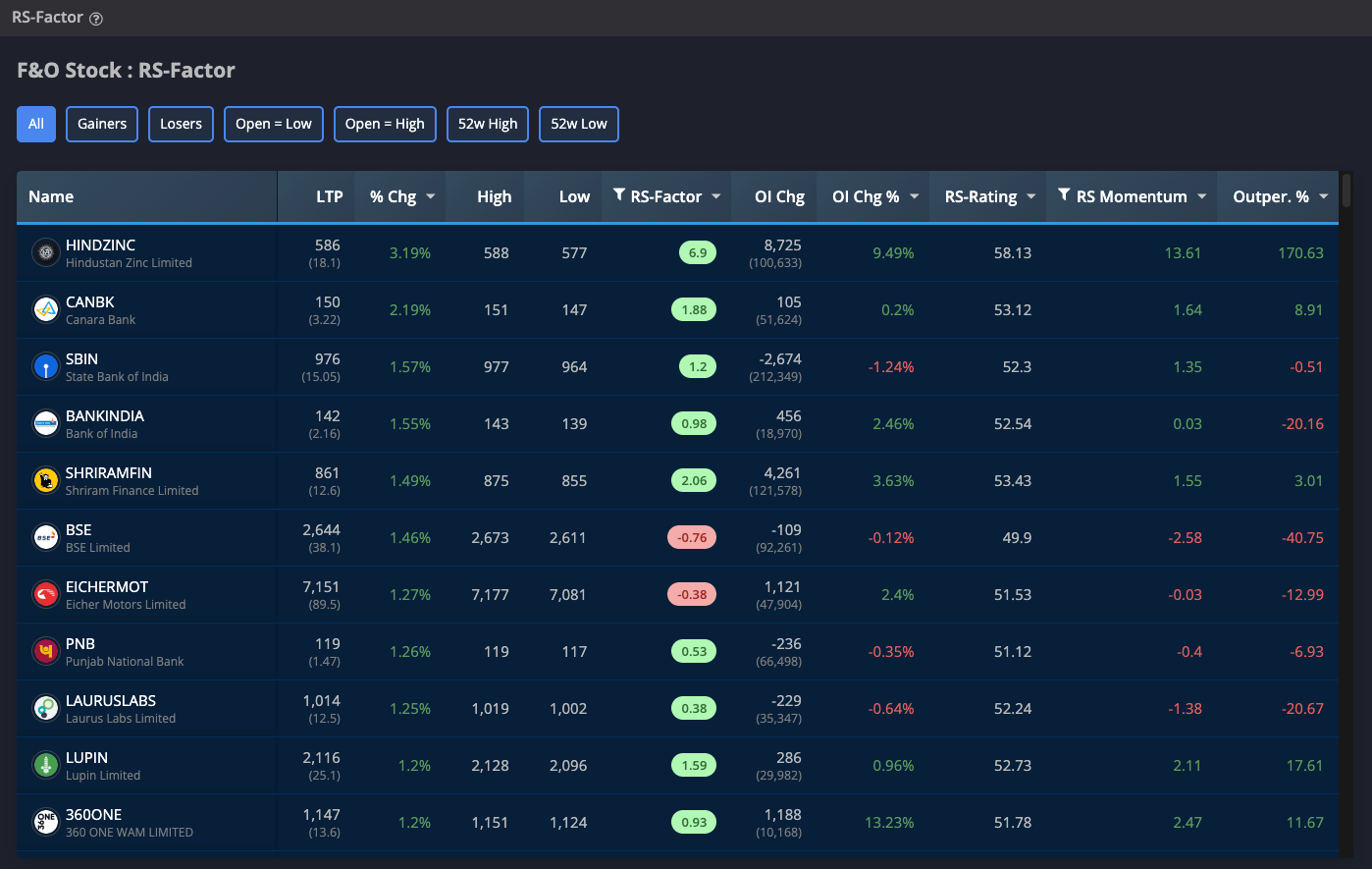

Added "RS-Factor"

The "RS-Factor" appears to be related to Relative Strength analysis - comparing individual stock performance against the benchmark index (Nifty 50). This is different from the risk-reward ratio "R" used in general trading. Also we added RS-Factor on F&O Stock & Sector Screener page.

December 15, 2025

All F&O stocks added in F&O Stock & Sector Screener and Performance Rotation Graph

We added 218 F&O stocks in stock, sector screener,ADR and Performance Rotation Graph section. It's help to identify which stock and sector trending.

December 10, 2025

Added "Intraday Boost","Breakout" and "Today High Low All" section in "Nifty50 Stock Screener"

We added "Intraday Boost","Breakout" and "Today High Low All". This data is useful for consider which stock momentum.

Intraday Boost = Last 20 day movment, and top is today high or low nearest. maybe breakout.

Breakout = Previous day high and low point consider as breakout point with time.

Today High Low All = Today high and low point consider as breakout point with time. Also added stock filter.

December 9, 2025

Added "Interpretation" column in "Option Chain"

We added Interpretation columns for CE and PE strikes. This data is useful for consider which side position buildup.

November 23, 2025

Added 1 hour timeframe in "Performance Rotation Graph (PRG)"

We added 1 hour timeframe for catch fast movement. This tool is Performance Rotation Graph (PRG) built using a custom algorithm and visualization method. This tools show sector and stock rotation performance using any benchmark index or stock.

November 23, 2025

Added Near and Far expiry Strike selection option seperated in "IV Calendar Comparison".

We added Near and Far expiry Strike selection option seperated in "IV Calendar Comparison". so you can easily select different strike near and far expiry.

November 18, 2025

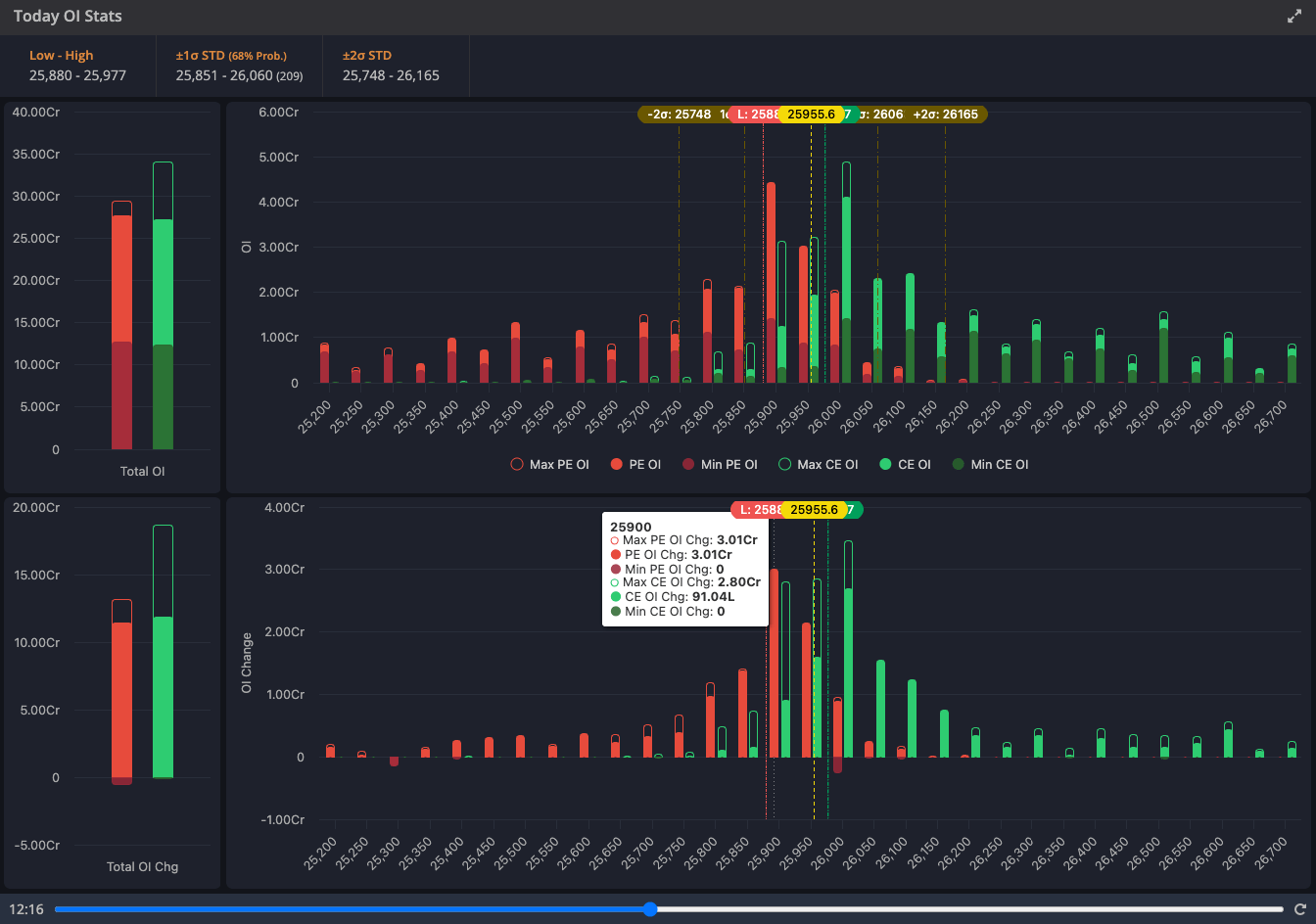

"Today OI Stats" added Min OI today, High, Low, ±1σ and ±2σ STD level.

We added "Today OI Stats" added Min OI today, High, Low, ±1σ and ±2σ STD level. so you can easily trake market trend and position movement.

November 13, 2025

IV Calendar Comparison added ±2σ to the VWAP to get upper and lower bands.

We added IV Calendar Comparison added ±2σ to the VWAP to get upper and lower bands. Its helps for where make calendar, take profit and SL.

November 03, 2025

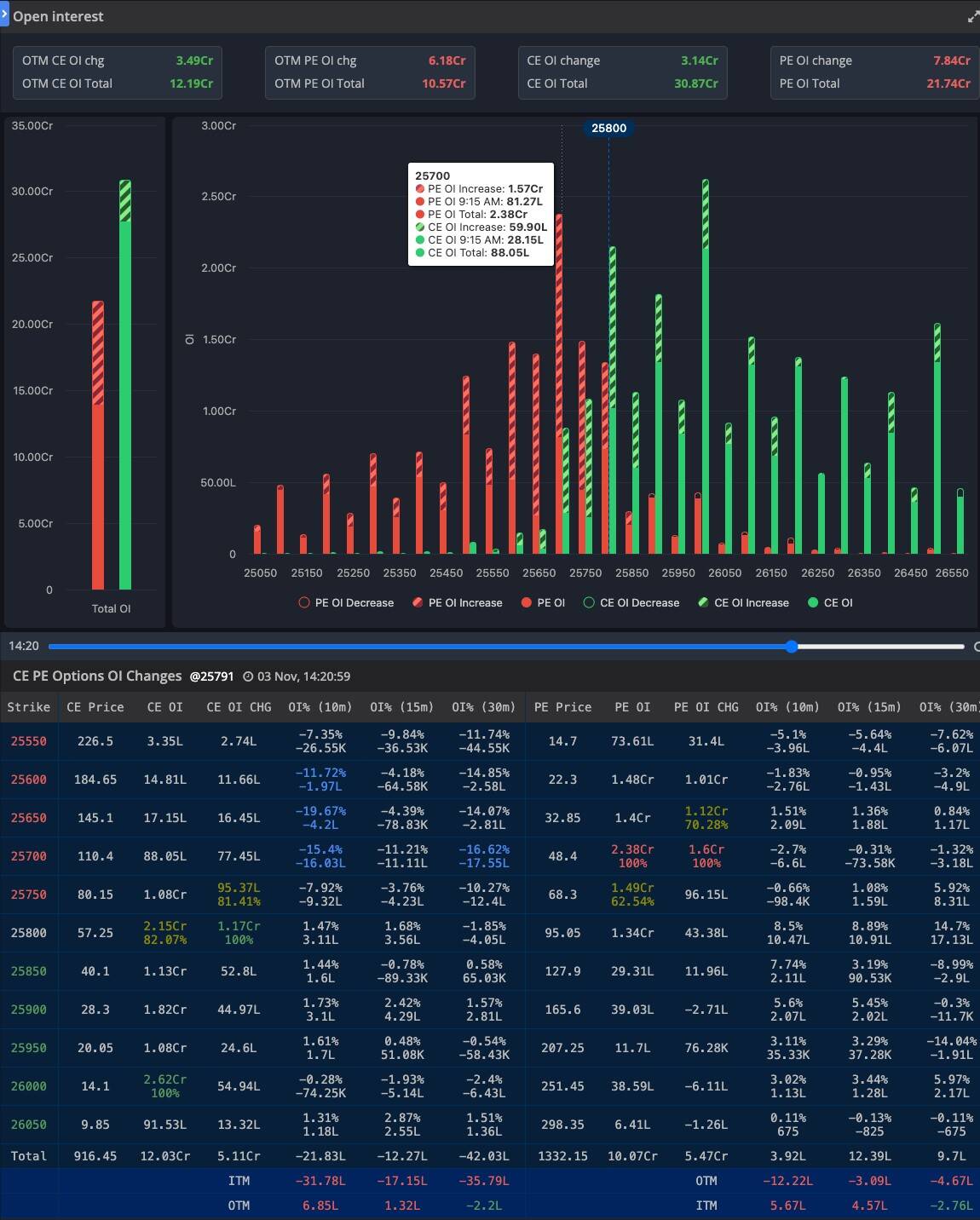

CE and PE "OI Change" columns added in "Open interest"

We added CE and PE "OI Change" columns for more deep OI vs OI Change analysis in table. also added top 2 high OI Chg highlight red and yellow color. so you can easily show which strick hold high total OI and OI Change.

October 31, 2025

Added "Performance Rotation Graph (PRG)"

This tool is Performance Rotation Graph (PRG) built using a custom algorithm and visualization method. This tools show sector and stock rotation performance using any benchmark index or stock.

October 20, 2025

Added "Delta" and "Gamma" section in "OI vs Price"

We added "Delta" and "Gamma" section for more deep analysis in OI vs Price chart.

October 11, 2025

Added "Advance/Decline Ratio (ADR)"

Check today advance decline ratio to quickly gauge the stock market sentiment for informed trading decisions. Track Nifty 50 stocks. you can trade Advance/Decline Ratio, Advance/Decline Line, Advance/Decline No. and Nifty spot with VWAP.

October 04, 2025

Added "Refer & Earn" program

Give 10% OFF, Get 15% Back! Share your referral link with friends! When they use it, any purchase plan so you get as a reward and your friend get off on pricing page.

October 01, 2025

Added "OIWAP"

OIWAP stands for Option Interest Weighted Average Price - it's a technical indicator used in options trading to identify key price levels where significant option activity occurs. CE OIWAP, PE OIWAP, Center OIWAP.

September 25, 2025

Added "IV and IV Chg %" columns in Screener table

We added Nifty50 FNO stocks screener table current IV and IV change %. Also available sorting option.

September 23, 2025

Added "NIFTY50 Stocks Screener"

We added Nifty50 FNO stocks Screener for analysis. (now data update every 1 min), Stocks screener (Gap Up, Gap Down, Top Gainers, Top Losers, Open = Low, Open = High, 52w High, 52w Low, Advance/Decline), Future Activity (Long Build-up, Short Build-up, Short Covering, Long Unwinding) and Sector screener Chart.

Added pages

August 30, 2025

Added "NIFTY50 Stocks"

We added Nifty50 FNO stocks for analysis. (now data update every 1 min)

August 18, 2025

Added "Decay reverse" option in Setting

This option set as per user requirment. some user Green is show as decay and some user need green as premium increase. so I have added Decay reverse option in setting Off/On button.

Off = Green is Decay / Red is Premium increase.

On = Green is Premium increase / Red is Decay.

Setting apply on bellow pages

August 10, 2025

Filter option add on "Option Chain"

Filter options are provided in the option chain so users can see only what they need. Example

(Delta < 0.5 and LTP < 100)

August 9, 2025

Added "Positional" option

This option is added to check the decay from specific date and time. This feature helps you to know where you are positioned and how many points of decay you have got till now.

August 8, 2025

Added "Chart Theme Color"

This option have currently 4 new chart theme option available. as per your preferred view set any theme. this option available on setting section.

July 31, 2025

Added "Scalping Trend"

The Scalping Trend by OptionLab is designed to measure the strength and speed of market trends, providing traders with actionable insights into momentum dynamics. Added with Spotm Spot EMA and VWAP.

Also Enable Live Feed Support

July 22, 2025

Added "Straddle Chain"

Using the straddle chain approach, an investor takes positions in both a call and a put with the same strike price and maturity date.

July 18, 2025

Strategy Builder Price Edit option with P&L

We have given an entry/exit price option and also given an edit option. And you can also add a new strike to the same strategy and do your strategy analysis. Apart from this, we have also added a P&L option to add strategy.

July 15, 2025

Live Feed Data using Upstox API

Integrate live market feed data into your application using the Upstox API to access real-time price updates. This allows you to track price movements, volume, and other trading signals instantly. By subscribing to live tick data, you can build responsive trading dashboards, charting tools, or automated strategies.

Upstox provides WebSocket support for efficient data streaming, ensuring minimal latency and high-frequency updates. Use API credentials to authenticate, subscribe to instruments, and manage real-time data securely. Ideal for traders, developers, and platforms needing accurate, up-to-the-second market insights.

Live Feed Support Links

July 13, 2025

Vega Pulse

Vega Pulse visualizes the real-time movement of Call and Put Vega, highlighting the volatility sensitivity of options. It helps identify shifts in market sentiment and potential volatility-driven trading opportunities.

June 30, 2025

Add Open interest, Delta, Gamma, Vega, and Volume Exposure better analysis features.

We added 5, 10, 15, and 30 minute changes on the table. We used both sides ATM ± 1% strikes.

Links

June 25, 2025

Straddle Charts

A straddle chart is a visual representation of a straddle options strategy, showing how the value of a combined call and put option changes in relation to the underlying asset's price fluctuations. It helps traders analyze potential profit or loss scenarios based on different price movements.

June 23, 2025

Trending OI Sentiment

Trending OI (Open Interest) sentiment refers to the analysis of Open Interest data to gauge market sentiment and potential price movements. It involves observing how Open Interest changes in relation to price movements, helping traders identify strong trends, potential reversals, and the overall market participation.

June 21, 2025

Added EMA

EMA add on Rolling Straddle, also you can change EMA value from setting.

June 12, 2025

IV Calendar Comparison

In a calendar strategy, you sell the near-term option with higher IV and buy the longer-term option with lower IV. This setup benefits from faster time decay in the short leg while the long leg retains more value.

June 1, 2025

Z-Score

The Z-Score is a statistical measure that tells you how far a value is from the mean, in terms of standard deviations. It's used to identify overbought/oversold conditions relative to historical behavior.

May 25, 2025

Backtesting Available

From now on you can view and analyze data of any past date.

May 8, 2025

Volume APEX and Exposure (VE) added

1. Volume APEX gives insight into market sentiment by factoring in not just how much was traded (volume), but also how directionally significant those trades were (via delta). It’s like weighted net volume.

2. Volume Exposure (VE) is a powerful tool for analyzing the impact of option trades (based on traded volume) on market movement through different Greeks: Delta, Gamma, and Vega.

OptionLab

OptionLab