When analyzing options data, it's important to choose the right expiry to get reliable insights. For weekly expiries, data tends to become meaningful only a few days before expiry (like expiry -2 or -1 day). Therefore, if the current date is just four days before the weekly expiry, it's often too late to rely on that data, as it might not reflect genuine market sentiment—especially due to low participation or sudden adjustments.

For example, if the weekly expiry is on 9-Apr-2025 and the current date is 4-Apr-2025, there are only 4 trading days left. The options data for that expiry is still being built and may not offer a clear or reliable picture of market direction.

In such cases, it's more effective to switch to the monthly expiry, which generally has higher liquidity, more stable data, and broader participation. Using the monthly expiry helps in drawing better conclusions about market strength, volatility, or trend.

| Regime | Gamma Structure of Current Day Options | Most Probable End Of Day Outcomes | Example |

|---|---|---|---|

| Positive GEX |

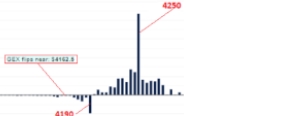

- Net gamma distribution mostly positive - Large positive gamma concentrated at single strike |

- Large Strikes act as resistance - Price closes away from peak gamma |

|

|

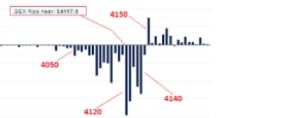

- Net gamma distribution mostly positive - Large positive gamma concentrated at 2 or 3 strikes |

- Price remains within range where it opened (below or between large strikes) |  |

|

|

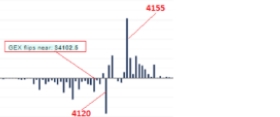

- Net gamma distribution mostly negative - Negative gamma spread across wide range of strikes |

- Price closes above most strikes with negative gamma - Large negative strike and GEX Flip point act as support |

|

|

|

- Net gamma distribution mixed - Gamma spread across wide range of strikes |

- Price closes within range between the strikes with significant negative and positive gamma |  |

| Regime | GEX Structure of Current Day Options | Most Probable End Of Day Outcomes | Example |

|---|---|---|---|

| Negative GEX | - 90% to 100% of gamma is negative AND concentrated at one strike |

- Price will look to close at the biggest pile. - Biggest pile will act as support. |

|

|

- 90% to 100% of gamma is negative - Gamma is scattered across multiple strikes |

- Price will chase the biggest piles. - Gamma may concentrate in one, two, or three strikes as the day progresses. - Open Interest charts provide additional insight. |

|

|

|

- More than 50%, but less than 90% negative gamma, concentrated in one or two strikes - Positive gamma is scattered across several strikes |

- Price will look to close at the biggest negative gamma pile. - The biggest negative pile will act as support. |

|

|

|

- More than 50%, but less than 90% negative gamma, scattered across several strikes - Positive gamma is concentrated in one or two strikes |

- The open interest chart would be helpful in determining price direction. - If puts outnumber calls, the price will attempt to move toward positive gamma (and vice versa). |

|

|

|

- More than 50%, but less than 90% negative gamma, scattered across several strikes - Positive gamma is scattered across several strikes - There are no predominant piles. |

- Price will look to close at the biggest negative gamma pile. - Open Interest charts provide additional insight. |

||

|

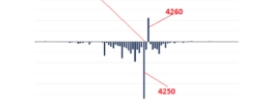

- 90% to 100% of gamma is positive - Gamma is scattered across multiple strikes. |

- Price will chase the biggest piles and GEX Flip Point. - Often seen when transitioning out of the negative GEX regime. |

|

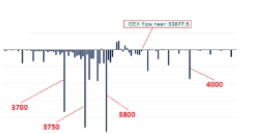

Gamma exposure (GEX) helps traders understand how options market makers may adjust their positions, which can lead to market movements. Here's how to interpret it:

Gamma exposure is the sensitivity of delta to changes in the underlying price. It is calculated as:

For each strike price, you will see call gamma exposure and put gamma exposure.

| Strike | Call GEX | Put GEX | Net GEX | Market Impact |

|---|---|---|---|---|

| 23500 | +2M | -1.5M | +0.5M | Stabilizing, dampens volatility |

| 24000 | +3M | -4M | -1M | More volatile, larger price swings |

| 24500 | +2M | -2M | 0 | Neutral, limited effect |

✅ High Positive Gamma Exposure (Stability)

❌ High Negative Gamma Exposure (Volatility Spike)

📌 Critical Levels → Strikes with extreme gamma exposure can act as support/resistance zones.

OptionLab

OptionLab